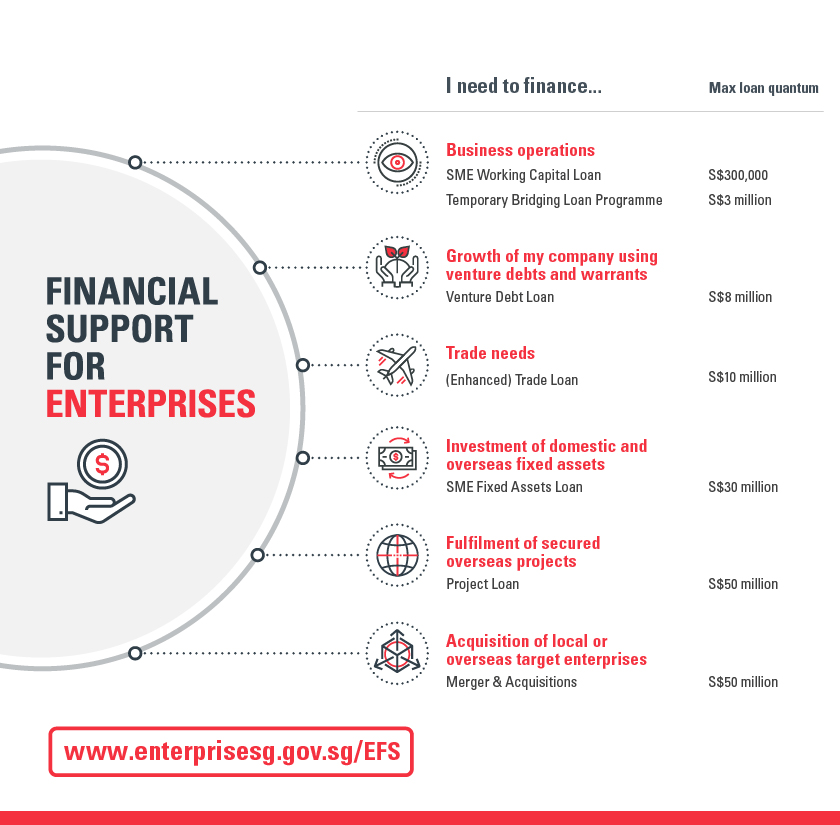

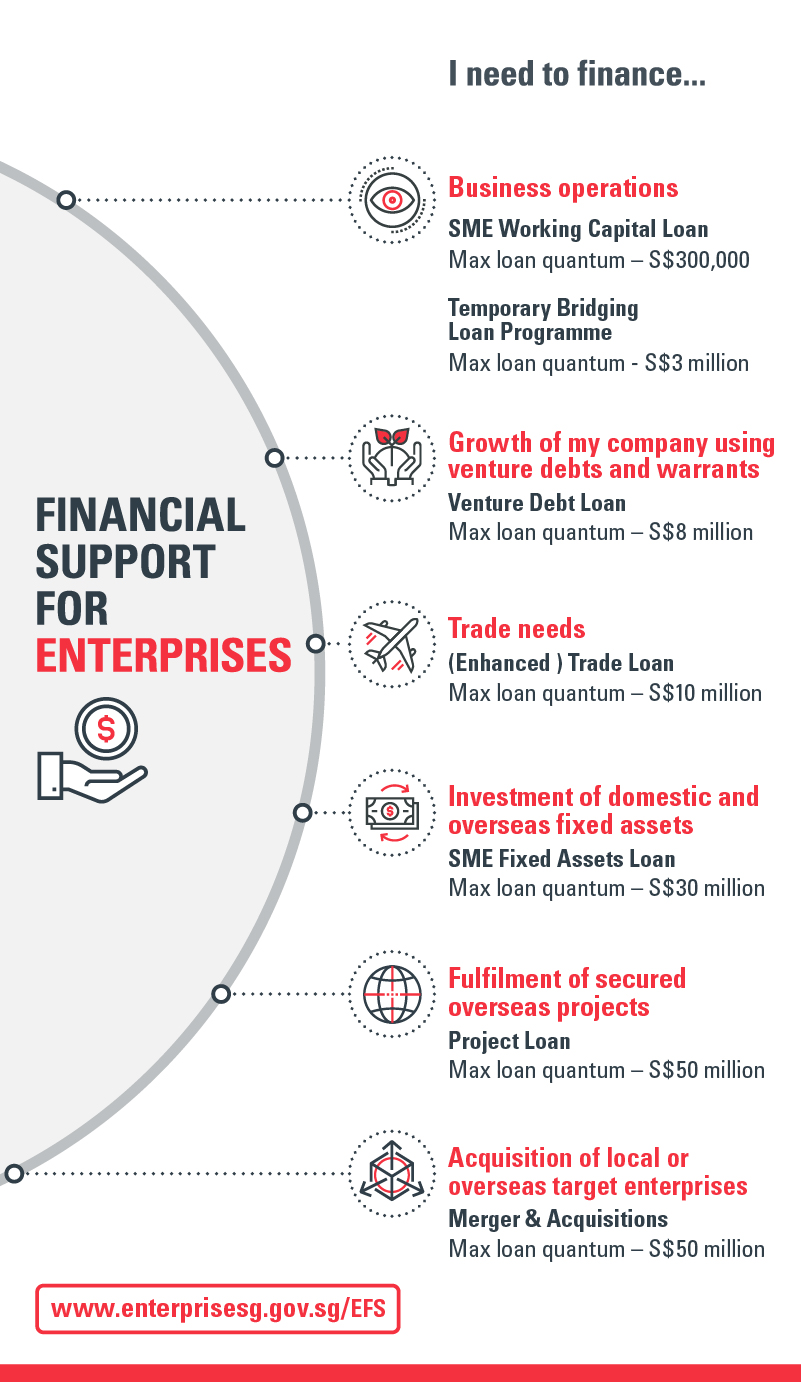

Find the right financing support

Due to the Covid-19 pandemic, many businesses may continue to face challenges in managing cash flows, accessing to credit and meeting your loan repayments.

Enterprise Financing Scheme (EFS) was enhanced to provide greater financing support.

.

For more information, click here.

6 things to prepare when applying for a loan

Company profile and business plan

Business plan:

- Company’s business nature, address, products, markets, key customers, management team profile and financials.

- Revenue and cash flow projections, working capital requirements and projected plans.

Tips:

Remember to include the company shareholding structure and company organisation chart.

You should calculate how much loans is required, how will this loan be utilise and provide information on how you intend to repay the loans.

Latest financial reports (up to 2 years)

Financial statements consist of:

- Profit and loss statement

- Balance sheet

- Cash flow projections

- Last 6 months of banks statements/current account statements of the main operating account

Tips:

Provide the audited financial statements for the last 2 years. In the absence of audited financial statements, prepare an updated management accounts.

You should take into account the various savings incurred from the various schemes, rebates or any grants received, and reflect these in the cash flow projections. Good to stress test the cash flow projections for different revenue scenarios.

If you have not digitise your business, do check out IMDA’s digital solutions for platforms that can help generate financial statements and transaction histories.

Account receivables and Account payable lists

- Account-by-account information, sales and payment history for the past 2 years

- Debtors’ and creditors’ ageing payment list (if available)

Tips:

This information will help the banks determine whether your business can smoothly operate without running into any cash crunch in the immediate future.

Directors’ personal identification and IRAS documents

Directors’ NRIC copy and personal Notice of Assessment (NOA) for the last two years.

Tips:

Directors should expect to sign a personal guarantee as part of the loan process, as it is common for a bank to require a personal guarantee for an unsecured loan.

Banking or existing loan facilities with other banks

Names of the lenders, type of facilities, outstanding loan amount, outstanding tenure, interest rate, and monthly instalment.

Tips:

Providing such information upfront helps the bank to better assess you and your business’s financial position and works into the loan package.

GST form F5 returns for GST-registered companies

A copy of the of GST form F5 returns, up to the last 4 quarters.

Tips:

You can download the GST form F5 returns (under Business Tax) from the IRAS portal using your corp pass.

NOTE: This is a guide for your loan application. Information requirements may defer from bank to bank.

Know your financial ratios

These formulas can help you assess the debt servicing capability of your company

A financial ratio of more than 1 indicates that your company is able to generate sufficient profits (cash flows from operating activities) to service loan repayment.

[Earnings before Interest, Taxes, Depreciation and Amortisation (EBITDA)] (Annual Interest + Principal Loan Repayments)

Cash Flow from Operations (Annual Interest + Principal Loan Repayments)

Another formula is the interest coverage ratio, which measures the strength of your business to service its interest obligation.

In general, the higher the financial ratio the stronger the financial position of your business to service interest payments.

[Earnings before Interest, Taxes, Depreciation and Amortisation (EBITDA)] (Annual Interest)

Cash Flow from Operations Before Interest Payment (Annual Interest)

For tips on how to get your business into a good financial position, visit here.