Imagine spending months planning your overseas business venture only find out that your products are stuck at the Customs due to overlooked licenses and permits required for the importing country.

“Spending some time to understand the customs and trade environment, relevant regulations and procedures will pave the road for smoother importation and exportation into a new market,” advised Mr Frank Debets, Managing Partner of PwC Worldtrade Management Services.

Having knowledge of the customs and tax regulations can help you better define the business operation model and legal entity structure to take on too. This would determine how you enter the market in the most optimal manner.

For instance, you can accurately price your goods and services when you have a holistic understanding of the market’s tax regulations, like customs taxes, value-added tax (VAT) or Goods and Services Tax (GST). Other tax considerations will have to be factored in right from the start too, such as the taxes applicable to the legal entity structure to set up and the tax cost on the repatriation of profits. These are dependent on whether certain compliance requirements are met.

For example, if an Indonesian company is repatriating profits back to its Singapore shareholder as dividends, it has to submit a duly completed Form DGT-1 so that it is eligible for the reduced dividend withholding tax rate of 10% under the Agreement between the Republic of Singapore and the Republic of Indonesia. This is to avoid double taxation and prevent fiscal evasion with respect to taxes on income. If not, a 20% domestic dividend withholding tax would apply.

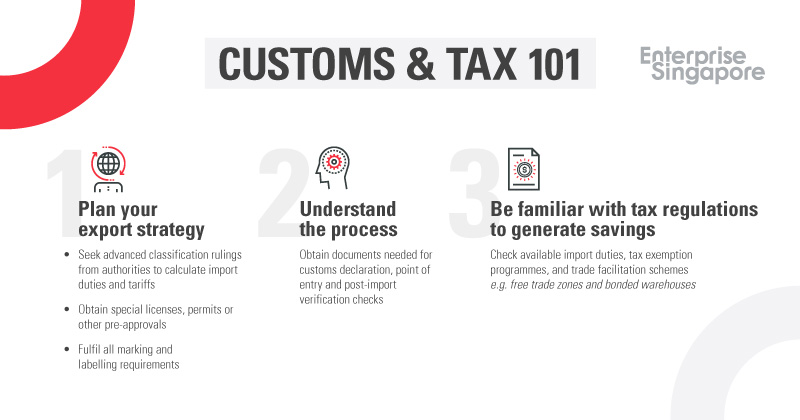

Having the knowledge to make informed decisions would allow you to maximize profits for your overseas ventures. Here are some tips to keep in mind :

Apart from researching on customs and tax regulations, you can take the first step by gathering basic knowledge on Singapore’s Free Trade Agreements (FTA) with other markets using the complimentary Tariff Finder tool. It provides information on import duties, FTA preferential rates and rules of origin criteria across a comprehensive coverage of over 150 destinations. Applicable local taxes, as well as general and specific import requirements or documentations can also be found.

This would help in speeding up the process of determining which markets to explore at the initial stage of planning.

Navigating customs regulations

Staying up-to-date on regulatory changes and understanding different clearance processes are some of the common problems companies face when exporting overseas. Some custom clearances may take up to several days or weeks, and be subjected to complete physical inspection at the port. Other obstacles include language barrier, as many of the customs and tax regulatory information are only available – if at all – in the country’s local language.

To help companies address these common pain points, PwC WMS can offer basic reports with targeted supplementary information, advanced advisory and consultation, or even provide in-country support.

Case Study 1: A company that was exporting garment products to Indonesia benefited from PwC WMS advisory on the set-up of a customs account, and the required licenses to import and supply textile products in Indonesia.

PwC WMS also offered a comparison of the different ports the company could use as a point of entry with regards to average clearance times, costs of customs declarations, distances between the port locations to the company's main warehouses in Indonesia while factoring road congestion.

Little known practices and rules that are applicable to specific markets will be shared. For example, as a new importer in Indonesia, one may be subjected to higher inspection rate – you can manage this from the start by engaging a third party to handle urgent importations instead of facilitating the cross border trade directly.

Understanding tax rules

Similarly, experts from EY can assist companies in navigating their tax compliance requirements in their markets of interest. Tax regulations applied in practice by the authorities can vary depending on the circumstances and intent of the laws, and confusion may arise if a company receives inconsistent information from different tax authorities.

Misalignment of tax treatments between two countries during cross border transactions may also lead to double taxation. Therefore, partnering with a tax advisor that has good technical and practical knowledge of the local markets is important to iron out such problems.

For instance, one area EY supports companies is the building of a sustainable corporate structure and operating model so that companies’ commercial needs are aligned with tax and transfer pricing strategies. Transfer pricing considerations are important given that authorities can impose adjustments if they deem the transfer price to be misaligned with the country’s guidelines. Setting an appropriate transfer pricing policy upfront can help companies to mitigate the risk of such adjustments.

Case Study 2: A Singapore-based advertising technology company that had operations in ASEAN, Taiwan and China, was looking to enter new markets. They wanted to assess if their existing operating structure was appropriate to facilitate flow of funds for reinvestment and whether there were inherent tax costs.

EY advised them from a tax and transfer pricing perspective, while highlighting the potential tax pressure points of its current operating structure. They then proposed an operating model that would mitigate tax risks and facilitate future flow of funds.

Ultimately, there is no one-size-fits-all solution for your trading strategy. As many of the customs and tax regulations are country and product specific, companies are encouraged to work with experienced advisory partners to ensure a smooth internationalisation journey.

To find out how to go global, click here.