AS INDIA’S manufacturing sector ramps up, Singapore companies are grabbing a slice of the pie – not least by supporting and supplying large multinational corporations (MNCs).

In 2022, the number of Singaporean firms that worked with Enterprise Singapore (EnterpriseSG) to enter India increased by more than 40 per cent compared to pre-pandemic 2019. Manufacturing was among the top three sectors represented in these companies, alongside information and communications and professional services, the agency said, but declined to provide exact figures.

Singapore remains India’s top foreign investor, investing US$15.9 billion in the fiscal year ended March 2022.

The draw of India

India is attractive for both its general economic outlook and specific policies in promoting manufacturing.

The government’s projection of 7 per cent growth for the fiscal year ended March 2023 puts it among the fastest-growing countries – well above the International Monetary Fund’s 2023 forecasts of 2.9 per cent for global growth and 5.3 per cent for emerging and developing Asia.

The country has been adopting pro-business measures in a bid to become a global manufacturing hub. It aims to raise the manufacturing sector’s share of gross domestic product to 25 per cent by 2025, from 16 per cent now.

In 2014, India embarked on its “Make in India” policy, aiming to draw foreign direct investment (FDI), noted G Jayakrishnan, EnterpriseSG executive director for South Asia, Middle East and Africa. In 2020, production-linked incentives were introduced, with payouts for the domestic production of certain goods.

Covid-era supply chain disruptions and geopolitical tensions have also prompted MNCs to diversify. In FY2021/22, India drew a record US$83.6 billion in FDI. Jayakrishnan noted that companies such as Apple, Samsung, Kia, Boeing, Siemens, and Toshiba, as well as their suppliers, have stepped up manufacturing activities there.

The influx of MNCs has benefited companies such as Reliable Hub’s Engineering India, a subsidiary of Singapore’s The Hub’s Engineering.

Reliable Hub’s Engineering makes and distributes equipment for retail and food services – such as shelves and billing counters – and supplies many big brands, including foreign entrants such as Mr DIY, Skechers and Miniso.

Turnover rose to 723 million rupees (S$11.7 million) in 2022, up from 148 million rupees in 2018.

One former challenge, noted its managing director Ranjit Yadav, was that many foreign companies needed local partners to enter India, as they were subject to a cap on foreign ownership. But now, 100 per cent FDI is allowed for firms in most types of manufacturing.

Supporting MNCs

Though Reliable Hub’s Engineering is an end-manufacturer, Ranjit said suppliers can also gain from the expansion of manufacturing MNCs in India.

As part of efforts to keep manufacturing in India, the government imposes high customs duties on imported components. This means manufacturers based in India have an incentive to find local suppliers and thus lower their costs, he said.

Almost every major MNC is now in India, said Gopal Bhandari, director of Clearpack Group’s Industry 4.0 arm Smart Factory Solutions.

Unilever’s India subsidiary, for example, has bought more than a hundred of Clearpack’s packaging machines.

During the pandemic, businesses in India could not get support from equipment makers overseas, such as those in China, Japan or Europe, he said. They thus grew more reliant on local players.

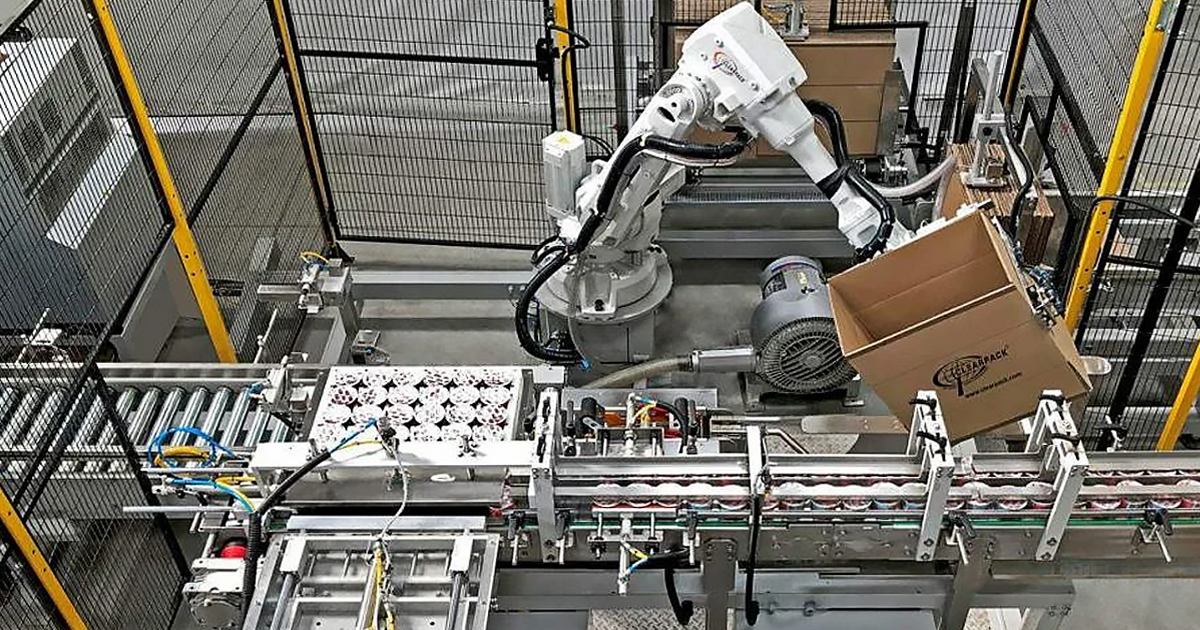

Growing acceptance of automation has also meant greater demand for higher-efficiency machines such as Clearpack’s industrial robots for packaging lines, he added.

Singapore-based Clearpack plans to set up a second factory in India in the coming months. In the past four or five years, it has doubled its team of service engineers in the country, to about 20 today.

India contributed about a quarter of Clearpack’s revenue last year, with 1.6 billion rupees. The group expects sales in India to rise 25 per cent in 2023.

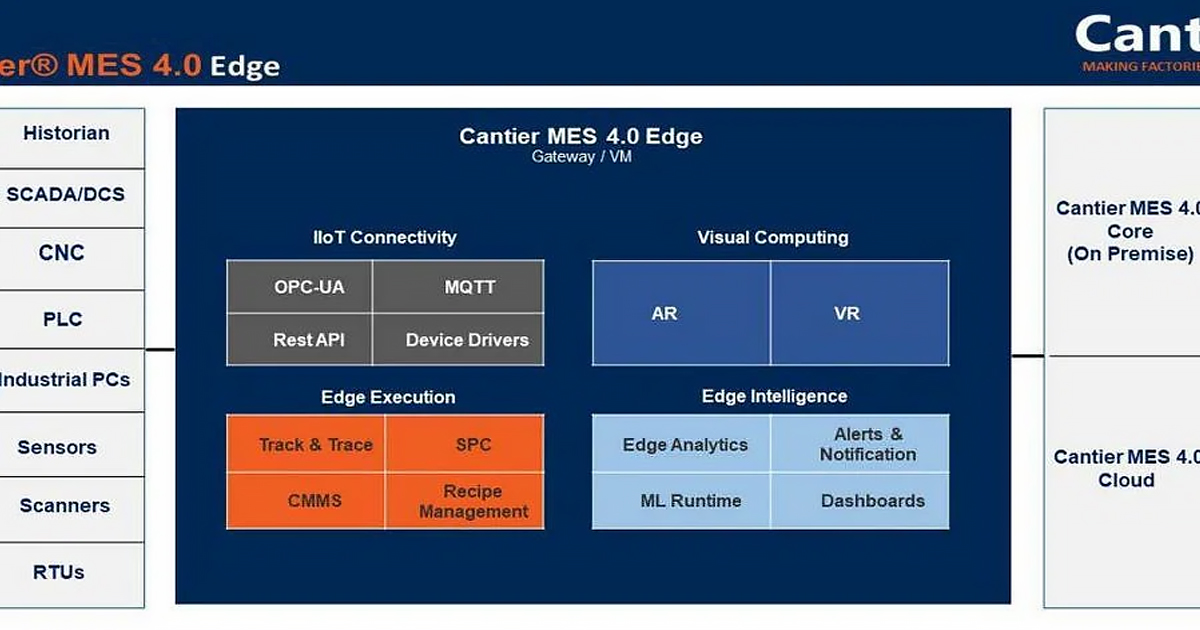

Singapore-headquartered Cantier Systems is also looking to hire more staff in India to handle a pipeline of five to seven new projects in 2023. The company provides software systems for factory operations, incorporating Internet of Things technology.

The company started executing its first project in India in 2021, working with “one of the leading tyre companies” in the country, said founder and chief executive officer Prabakar P Selvam. Within the year, revenue from India was equal to the total from the rest of Asia-Pacific.

The nation’s semiconductor, automobile, aerospace and automotive industries have grown and evolved in recent years, Prabakar said: “Totally new things are coming in.” This includes a growing appreciation of Industry 4.0 methods.

Singapore’s CEH Group has seen this rise first-hand, having entered the Indian market two decades ago. It has two divisions there: Pumas Automation, an automation solutions provider for textile and pharmaceutical industries, and RIM Polymers, which produces polymer-manufacturing machines for automotives and home appliances.

Back then, both divisions were “working in very low volume business as India’s economy was still not so open”, said Oei Han Tjing, the group’s executive vice-president.

Business has picked up since 2014, with growing interest in Industry 4.0, government initiatives drawing MNCs, Indian manufacturers expanding, and its Korean customers setting up plants there.

Recent US-China tensions have proved particularly beneficial for Indian manufacturers, Oei added. Europe, the US and Japan are “changing direction”, moving away from investing in China: “Now they want to help India.”

Both divisions in India saw growth average about 15 per cent in 2022, recovering from a dip during Covid. In 2023, the expectation is for Pumas to maintain this rate and for RIM Polymers to grow slightly faster.

Providing components

Growth has also been strong for Sanwa Synergy India, which supplies components to electrical and automotive manufacturers. A joint venture between two Singapore companies, it entered India in 2012 to help an MNC – one of the two companies’ clients – localise its operations.

Since then, capacity and revenue there have grown 30 per cent year-on-year on average, with the latter hitting US$7 million in 2022.

Plant director S Velmurugan noted that MNC customers have continued to add capacity with Sanwa Synergy. It has about 25 injection moulding machines in the country, and intends to add five or six more in 2023.

The company imports the latest machines from Europe, even though these are “quite expensive” compared to local brands that local competitors may use, he added.

To help Singapore firms grasp these opportunities, EnterpriseSG works with Indian agencies such as the Confederation of Indian Industry (CII). Last October, it partnered CII to bring 19 Indian corporates to Singapore for the Industrial Transformation Asia-Pacific event, where business matching sessions were held.

Singapore companies have attended trade shows such as the CII Smart Manufacturing Summit at FutureTech 2021, with more business missions upcoming. One point of focus is Tamil Nadu, India’s most industrialised state, which is home to fast-growing manufacturing clusters with about 39,000 registered factories.

Said Jayakrishnan: “Given the vibrant manufacturing sector in Tamil Nadu, EnterpriseSG is also actively working with Singapore companies to pursue manufacturing projects in the state.”.

Source: The Business Times © Singapore Press Holdings Limited. Reproduced with permission.