China will soon take the lead in global tech as Chinese companies continue to break new ground – with the government’s support in driving innovation and artificial intelligence (AI) in multiple cities. This means more competition for tech firms worldwide, but it also means opportunities.

Earlier this year, we organised a business mission for AI start-ups to Beijing, Shanghai and Nanjing. Here, industry players – including global and Chinese tech companies as well as venture capital (VC) firms – offer tips to Singapore firms looking to enter the Chinese tech scene. We distill the key points into four key takeaways.

1. Solve a Problem

In order to gain traction in China, having a good technology is not enough. “It’s important to have a product-market fit instead, where your product or solution answers an actual market demand,” says Tony Gu, Chief Investment Officer of Chinese VC firm GSR Ventures. Mr Gu advises that Singapore companies should begin by identifying a problem that they want to solve.

Sam Lai, an innovator at BMW China, agrees. The BMW innovation team leverages China’s innovation and startup networks because these people know the ground and understand the problems, he explains. BMW then partners with these startups and helps speed up their tech developments.

Industry players caution foreign companies to stay away from sensitive markets such as defence and cyber security. Every country is mindful of its national security and will naturally create a barrier that prevents foreign players from entering the sector.

2. Prioritise Your Business Model

Investors that Enterprise Singapore spoke to repeatedly highlight the importance of a business model, which is often a more significant consideration for them than a company’s product or solution.

“Investors want to know how viable and sustainable your business is. Companies need to convince investors of the potential of their technology to achieve sustainable high growth,” says Ma Yuchi, Chief Operating Officer of Trio.ai, a Beijing-based AI startup.

To gain marketing and pitching experience, meet more media professionals, sharpen your pitch and test it extensively with investors, Mr Ma adds. Trio.ai met more than 600 investors before completing four rounds of fund-raising from 11 investors in two years.

Industry players also observe that Chinese unicorns achieve their success not always because of technology, but because of innovative business models built upon knowledge of the local market. This gives them the ability to achieve lower operation costs and gain more revenue.

Yao Yaping, Founding Partner of VC firm Alphax Partners, shares three tips on sharpening one’s value proposition. First, a company’s business model must consider the market size that its solution is addressing and offer exponential growth after a certain tipping point, where the marginal revenue is higher than marginal costs. Second, the company must be clear in its positioning. Finally, the company needs to understand its valuation and be bold to negotiate the shares allocated to investors.

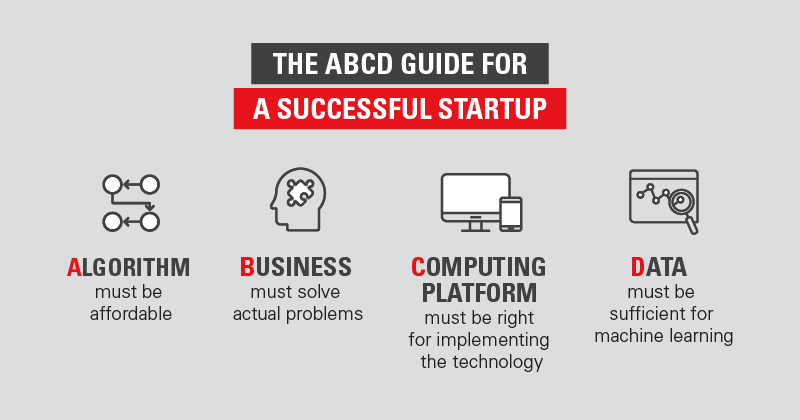

Hansen Huang, General Manager of the Startup Acceleration Programme of NVIDIA’s China and Hong Kong office, offers an “ABCD” approach to developing business models.

As Chinese companies tend to learn quickly from others and replicate similar solutions themselves, industry players advise Singapore companies to have intellectual property (IP) as part of their business model. “It’s important for startups to work on its IP strategy. Tap your IP in your home country and expand on it – for example, by having exclusive distribution rights for market entry into China,” says Rami Blachman, Founder of the China-Israel Innovation Accelerator.

But while foreign players can safeguard their tech IP, China’s cutting-edge innovators have been developing their own capabilities – and they are doing it fast. The key is to also collaborate with these innovators in China to achieve more.

3. Choose the Right Collaborators and Investors

Singapore companies can gain from a strategic partner in China and a Chinese VC to validate potential partners, says Mr Blachman. He adds: “Having a Chinese mentor to advise you is important because doing business in China is different from anywhere else. A local Chinese team is also crucial to achieve success in China – although this means resources are needed to maintain the team.”

Mr Ma of Trio.ai agrees that while it is beneficial for foreign startups to collaborate with big companies in China, this does mean that the startups begin at a disadvantage due to their low bargaining power. Nonetheless, startups need to weigh that against the advantage: the worth in a collaboration like this is in its marketing value. “To overcome the disadvantages, startups will have to think creatively on how to gain by developing new business models, such as doing profit-sharing on a variable component or through a pay-per-use licensing model,” says Mr Ma.

In the area of choosing investors and VCs, Singapore companies must do extensive homework. Mr Yang Ge, Founder of Sky Saga Capital, a VC firm, says that even as legal documents may be endorsed by investors, they mean nothing if the money is ultimately not credited into the company’s bank account. “One has to do due diligence on the background of the investors. A simple benchmark is the reputation and credibility of the investor in the community,” says Mr Yang.

In addition, good investors and VCs do not just look for an exit plan. Instead, they are genuinely interested in sharing their resources and networks to develop companies.

4. Invest in Talent

Industry players agree that talent is the key to attracting investors – and the money. Mr Yao of Alphax Partners describes a best-case scenario: “A star startup team in China today will feature senior management, researchers or scientists from reputable companies such as the Baidu-Alibaba-Tencent or BAT family. These people have recognisable industry expertise. Alternatively, academics from top universities are also in demand.”

The tech industry has a very positive image in China because of its association with entrepreneurship. These days, Chinese graduates are more willing to work for startups than multinational companies.

Geographically, cities that have the right talent for the tech industry are Beijing, Guangzhou, Shanghai and Shenzhen, where innovation is vibrant. Tech and especially AI startups are also achieving high valuation, which allows them to hire better and more talent that eventually benefits their commercialisation plans.

How Enterprise Singapore Can Help

Already considered the four moves above? Please reach out to us at go.gov.sg/askenterprisesg if you’re seeking to take your enterprise into China and want to be better equipped.